How to calculate the cost of borrowing

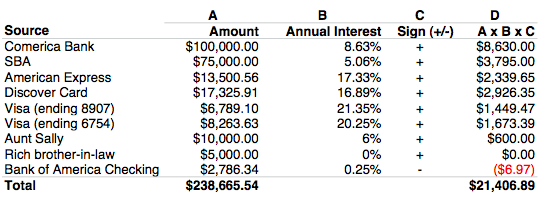

Required Calculate the eligible. The new AIR is.

4 Easy Steps To Calculate The Cost Of Money Ordoro Blog

A mathematical technique is to calculate what interest rate would satisfy the amortization formula for a 990 loan for 12 payments of 8885.

. You can calculate an estimate of effective cost using a fairly simple formula. For the figures above the loan payment formula would look like. The answer is 1392.

Before you do you should check out the true costs of such a loan with this calculator. 4211 What to know before you sign a loan agreement. W5Cost of the Asset at 31122013 250002000015000 6545 66545.

Taking an investment loan min. Interest Deductibility and Cost of Borrowing Calculator Use this calculator to estimate interest deductions and cost of borrowing savings. Borrowing from a 401 k Thinking of taking a loan from your 401 k plan.

This will show you how the interest rate affects. Want to Learn More. What rule can one apply to.

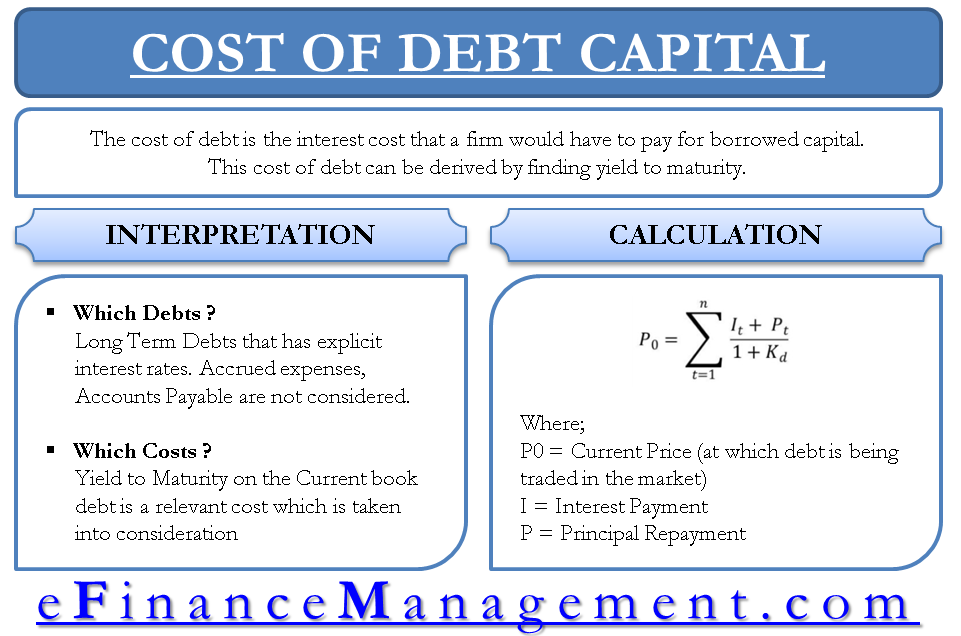

Answer 1 of 3. The frequency of repayments for. The cost of funds is basically the banks own interest rate for using their customers money.

424 The effect of interest. First find the total finance charges by adding all of the interest charged over the life of the loan to other fees. 4210 Rights and responsibilities.

Enter the amount into the box. Enter the amount into the box. W4 Weighted Average Borrowing Cost Rate.

The amount you want to borrow. The cost of any fees you might have to pay. Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year.

Working out the true cost of borrowing means taking into account. 428 Tips to keep borrowing costs down. To comply with the new Ontario legislation January 1 2009 the cost of borrowing is 66313.

You must however pay back 250000 to the lender. 425 The cost of different types of credit. The amount you want to borrow.

Multiply that figure by the initial balance of your loan which should start at the full amount you borrowed. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to Calculate button. For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500.

Use the slider to set the. Choose how much you want to save or borrow. Use this calculator to estimate interest deductions and cost of borrowing savings.

This equation should help understand how cost of funds is calculated. The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF BORROWING. 423 The cost of borrowing.

How to use our calculator.

Learn The True Cost Of Borrowing Birchwood Credit

Accounting For Borrowing Costs Overview And Example Accounting Hub

Cost Of Debt Kd Formula And Calculator Excel Template

How To Estimate Realistic Business Startup Costs 2022 Guide Bplans Start Up Financial Analysis Starting A Business

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

Excel Formula Calculate Interest Rate For Loan Exceljet

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Excel Formula Calculate Loan Interest In Given Year Exceljet

Financing Fees Deferred Capitalized And Amortized Types

Cost Of Debt Kd Formula And Calculator Excel Template

Understand The Total Cost Of Borrowing Wells Fargo

Borrowing Base What It Is How To Calculate It